Pension reform bills in Congress are weak

In the months following the Enron collapse, members of Congress started talking about all kinds of reforms -- tax reforms, accounting reforms, pension reforms.

After all, Enron executives had cut a wide swath. They cheated the U.S. government out of tax revenue by banking offshore, defrauded their shareholders with accounting tricks, and stole their employees' pensions by freezing the employees' 401(k) accounts so executives could sell their Enron stock while the price was still high, only unfreezing them after the stock was worthless.

If the world were governed by the laws of fairness, these people would end their lives in prison. But we are governed by the laws Congress makes. It is still unclear what laws they have broken -- if any.

And for all their talk of reform only a few weeks ago, Congress now seems content to leave things as they are.

No surprise there. This year's Congress is essentially the same Congress that squashed President Clinton's attempts to outlaw offshore tax havens. The Center for Public Integrity estimates that these money launderers cost the U.S. Treasury $195 billion a year, money that the rest of us taxpayers have to make up. But the only tax reform the Republican held Congress passed was a law making it difficult for the IRS to audit wealthy people. Now workers poor enough to qualify for the Earned Income Credit are three times as likely to be audited as taxpayers making over $150,000 a year.

Accounting reform is no more likely to happen. Harvey Pitt, President Bush's chairman of the Securities and Exchange Commission (SEC), used to be a lobbyist for the accounting industry. He believes accounting regulations should be "voluntary." President Bush agrees, opposing rules that would make corporations report the true cost of executive stock options.

Pension reform was the only one that seemed to have a chance. Since December, lawmakers have introduced 13 pension-reform bills. With all that activity, you'd think they could pass a law to protect your retirement money.

Unfortunately, the only bill that has gotten through the House of Representatives is President Bush's plan to reform 401(k) pensions. His plan would require the company to inform you when they make changes to your plan, allow you to get investment advice from the company managing your 401(k), and allow you to sell employer-matched stock in your account after only three years.

The problem is that none of these reforms would have saved Enron employees from losing their entire life savings when Enron went bankrupt.

Enron informed its employees about the freeze that destroyed their pensions. Simply informing isn't enough. Workers need to be involved in the decisions.

Advice wouldn't have helped them, either. Wall Street investment advisors considered Enron one of the best bets on the market. In fact, only four days before Enron filed for bankruptcy, two of the most respected investment firms in the world -- JP Morgan and Credit Suisse -- still rated Enron stock a "strong buy" or "long-term buy."

The problem with 401(k) reform is that, at the end of the day, you still have a 401(k). These accounts are a good supplement to defined benefit retirement plans, but they are not well-suited to being your primary pension plan.

The main problem is their size. Most workers are lucky to be able to put a few thousand dollars a year into their 401(k)s -- not nearly enough to allow them to diversify sufficiently to protect their investments.

Traditional defined-benefit pension plans combine the deposits of a large number of workers into an investment pool. Using this large pool, they can buy stock in hundreds of companies across the entire spectrum of the economy. A decline in one company's stock -- even a bankruptcy -- does not significantly affect the overall value of the fund.

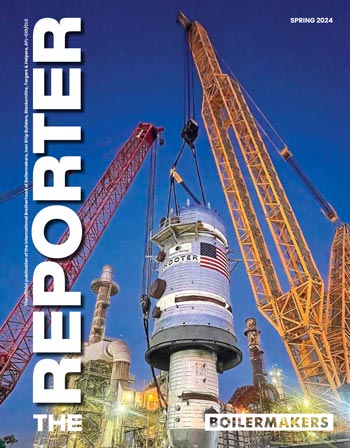

A good example of this advantage is the Boilermaker-Blacksmith Pension's Enron experience. Like most pension funds, the Boilermaker Blacksmith Pension held some Enron stock. When Enron bankrupted, our fund lost about $5 million. That's a lot more money than any investment manager wants to see go out the door.

But this loss accounts for less than one-tenth of one percent of the $6 billion Boilermaker-Blacksmith fund, so it will have no noticeable effect on retiree benefits.

No individual can spread his investments that widely.

Pooled-fund pensions have another advantage, too. Benefit payment levels are based on average life spans, but few people live exactly the average span. Funds left over when people die earlier than average are used to pay benefits to those who live longer. That way, everyone gets full benefits for life.

But a 401(k) can run out if you live longer than average, leaving you without a pension check at an age when you probably won't be able to go out and get a job. To guarantee yourself full retirement benefits for life, you need to have a lot more money in a 401(k) than you would in a defined benefit plan.

A 401(k) pension plan is a much better deal for the company than for the worker. By issuing stock to match worker contributions, the company not only avoids the cash outlays associated with defined-benefit programs, but they also gain more control over the supply of shares of their company stock. That control can enable them to influence the stock's price.

Their advantages to the businesses that have them is the reason they have become so widely used. About 42 million Americans now have 401(k)s. Many Boilermaker members have 401(k)s as their only pension plan.

Our Research and Collective Bargaining Services Department can help these lodges negotiate better 401(k)s. Some improvements they might ask for are more member involvement in plan changes, more unbiased investment advice, limiting the amount of company stock to no more than 20 percent, and having the company match employee contributions at least partly with cash instead of company stock.

Your International is also ready to help you negotiate participation in the Boilermaker-Blacksmith pension into your contract. We believe this multi-employer plan is the best retirement plan for Boilermakers.

Whatever you decide, you need to act on your own behalf and protect your pension through collective bargaining.

If you wait for Congress to enact effective pension reform, you could be waiting a long time.